10 popular questions about monetary policy

15 Apr 2024 - Dario PerkinsSummary Since the start of the year, global investors have been particularly keen to understand global monetary policy – in terms of both the impact interest rates are having on the macro economy, and the prospects for.

Where are we in the cycle?

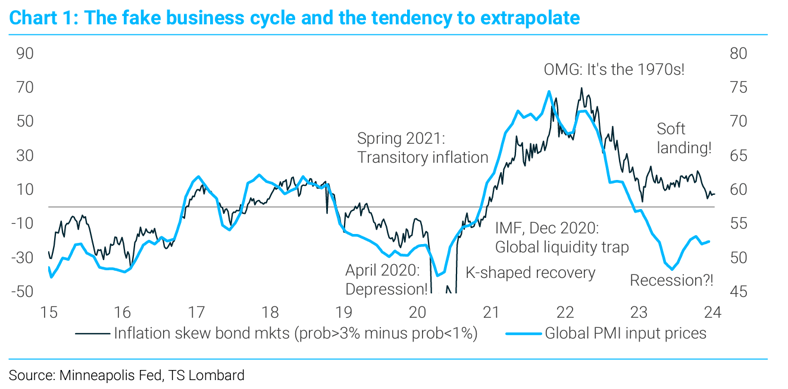

07 Feb 2024 - Dario PerkinsCompared with many of my peers in the financial industry, I’ve been using a very different framework to analyse the evolution of the global economy since its reopening from COVID-19. While most have fruitlessly tried to.

2008 PTSD VS THE GHOSTS OF THE 1970S

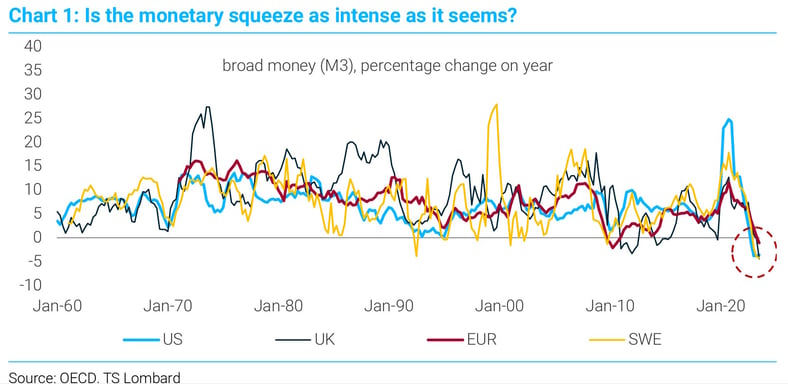

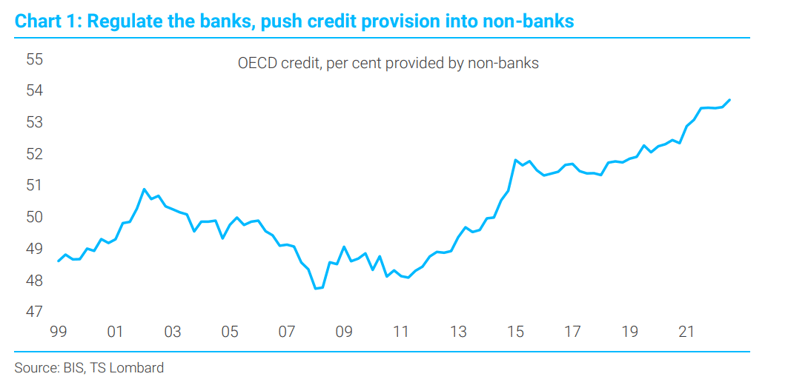

31 Mar 2023 - Dario PerkinsCentral banks have been raising interest rates aggressively for just over a year. During that period – the fastest and broadest monetary tightening episode in history – investors have been anxiously waiting for.

Shorter and Less Variable

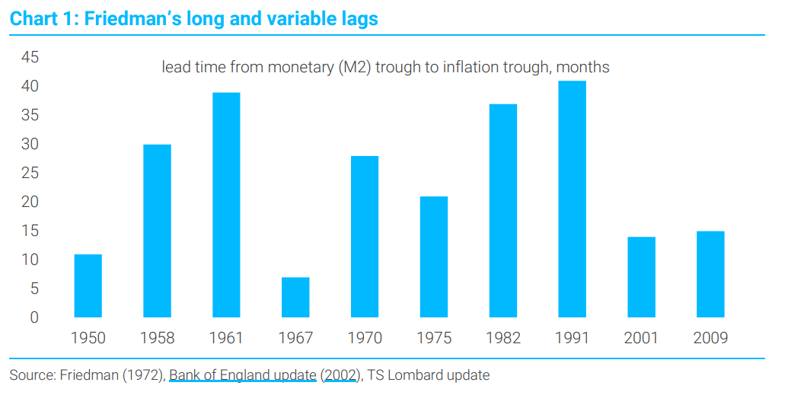

02 Feb 2023 - Dario PerkinsThere is a bull market in sellside economists predicting recessions. Ask any of them why they believe 2023 will produce an even worse macro environment than 2022 and you can be sure the words “long and variable lags”.

Things that won't happen in 2023

21 Dec 2022 - Dario PerkinsSince we first published our annual “Things that won’t happen” outlook in 2015, writing outlandish non-forecasts has become considerably more difficult. Back then, nobody would have taken us seriously if we had said.

Inflation was always the Endgame

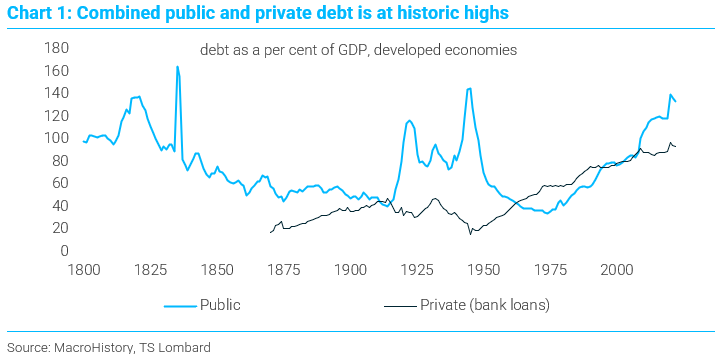

04 Nov 2022 - Dario PerkinsThere is beautiful irony in macroeconomics, a sort of inherent Minsky dynamic, or universal Goodhart law, that means that just when everyone thinks something is definitively true, it turns out to be spectacularly false..

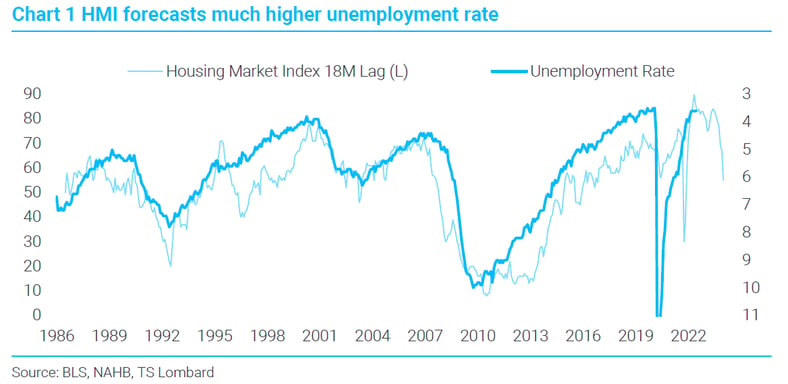

#Federal Reserve #Monetary Policy #Interest Rates #Recession #UnemploymentHow High for Unemployment in the coming US Recession

26 Jul 2022 - Steven BlitzThere are any number of ways to dissect the spread between the 7% job openings rate and 3.5% unemployment, but the needed drop in demand’s contribution to current inflation occurs when this spread turns negative..

#Federal Reserve #Monetary Policy #Interest Rates #Recession #UnemploymentOptimism: Mild US recession followed by a recovery and 2% inflation

18 Jul 2022 - Steven BlitzThe story of this cycle does not end when recession begins, the story, in fact, begins with the direction Fed policy takes once unemployment starts to rise. Recession of some sort was always inevitable to curb.

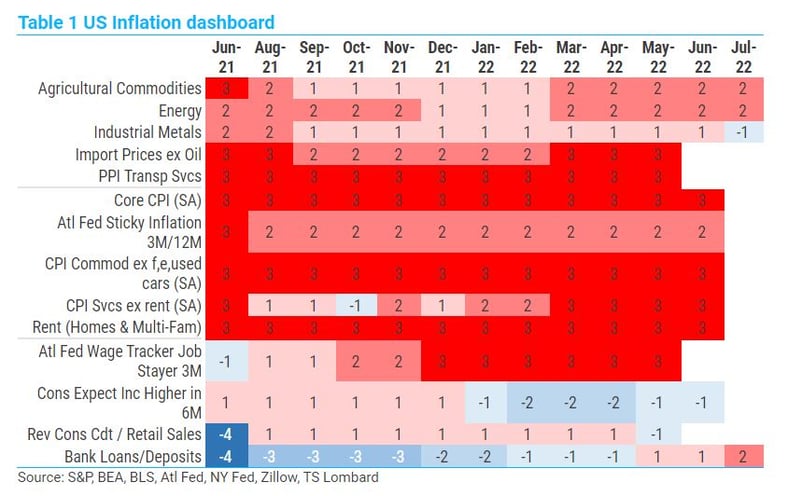

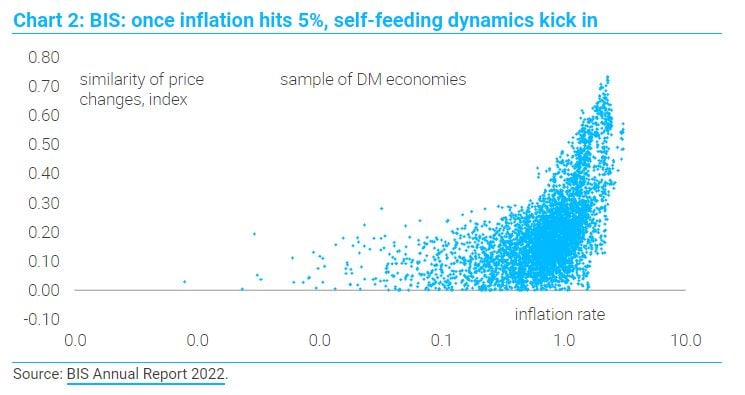

#Federal Reserve #Monetary Policy #Inflation #US EconomyThe nightmare scenario for central banks

14 Jul 2022 - Dario PerkinsEvery investor wants to know whether central banks are prepared to cause a recession in order to force inflation down. Surely, officials are bluffing, right? But think about it from the central banker’s perspective..

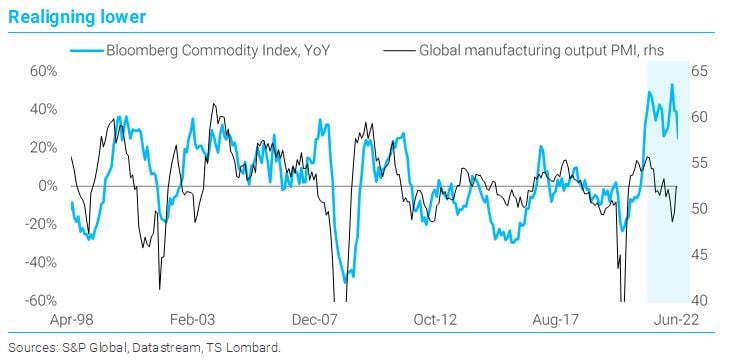

#Central Banks #Monetary Policy #Eurozone #United KingdomCommodities: burden of proof is with the bulls

07 Jul 2022 - Konstantinos VenetisThe breadth of the commodity rally started narrowing in early March, when the dust from Russia-Ukraine shock began to settle. Industrial metals topped out first and rolled over decisively in April – around the same time.

#Federal Reserve #China #Commodities Client Login

Client Login Contact

Contact