Real yields

We said: 4th of October we said: “Yields facing secular uptrend; hard for yields to fall while the swamp is draining, but upward pressure to relent when Treasury is done replenishing its account.” Yields won't relent until they stop draining the swamp… and then only temporarily”.

Outcome: In late October UST hit 5% and duly pared back as the TGA rebuild.

Chip cycle boost for East Asia

We said: In August, we said the semiconductor cycle had started a cyclical upswing one that would support Korean and Taiwanese growth and assets.

Outcome: We upgraded Taiwan in August, and Korea in November with respective equity indexes up 7.6% and 3.1% as of January.

Long India vs short China equities

We said: Hopes of a more robust China stimulus have faded, ideology will limit the extent of new measures. India will benefit as investors rebalance out of China, while markets are further supported by easing inflation and solid growth,

Outcome: We closed the position in September with a total return P&L of 8.0%.

China's surging EV exports to stoke EU protectionist response

We said: Said that the EU’s auto sector led by Germany were among the firms most at risk from China's rising EV exports and argued well ahead of consensus that this would force EU policymakers to react by imposing protectionist measures.

Outcome: In Sept 2023, the European Commission announced it would launch an anti-subsidy probe into EV imports from China.

Equity market call

We said: In June 2023 said equities would sell off, rally, and then sell off again before surging higher in late 2023. Equities would face headwinds as the TGA rebuilt but then rally when that process reached a conclusion and people simultaneously began to price in more Fed cuts in late 2023.

Outcome: US equities followed that exact pattern

US Inflation

We said: 2023 was year of ‘Disinflation mirage’ or ‘immaculate disinflation’, a call we made in mid-2022. Since then, we’ve launched our inflation pages, providing a stable of leading indicator charts, updated monthly with the CPI release, holding to our call that inflation would continue to slow, remaining benign into 2024.

Outcome: We caught the peak in headline price rises as May 2022. Disinflation has since taken hold, the October CPI print confirming this

EA Inflation

We said: After correctly timing the peak in EA HICP and the beginning of disinflation in July 2023, we consistently pointed to disinflationary trends gathering momentum alongside higher frequency of core downside surprises through autumn, despite continued ECB hawkishness.

Outcome: Market’s inflation consensus forecasts adjusted downwards and so did ECB’s own projections for 2023 and 2024. With downside inflation surprises, the ECB opened the door to a policy pivot.

Rearmament: A lasting investment theme

We said: Since the Russian invasion, defence stocks have been strong outperformers. We countered that rearmament was priced in. Forward-looking analysis of the Ukraine war and its global ramifications concluded that the rearmament theme has staying power

Outcome: The “Future of Defence” ETF (NATO LN) launched in the same month as this note was published returned 15.5% by end-2023 (annualized return of 34% vs 24% for the S&P500 in 2023).

Asset Allocation call for 2023

We said: Conservative on risk overall, but with strong asset class/ regional biases (e.g. EA vs US equities, large Corporate Bond overweight) for the first 4 months of 2023. Negative China equities in June and bullish US equities in August

Outcome: 2023 performance for AA model portfolio: +20.2% return, 9.3% volatility

Bullish Japan Equities

We said: In April 2023 went overweight Japan equities and upgraded to +1 in June, maintained that +1 all through 2023 and into 2024.

Outcome: April-December 2023 Japan: +20%

Bullish Brazil Equities

We said: End of monetary tightening cycle would boost equities, valuations remained exceptionally cheap while the currency was also undervalued vs pre-pandemic levels. Hedged commodity exposure with short South Africa pair.

Outcome: Closed 12 June for return of +9.5%. Replaced the trade with an outright long Brazil equity to signal our growing confidence in Brazil outperformance. As of end of December trade was up 10%

China growth to suffer in 2023

We said: China would struggle in 2023 as deep scarring left by covid, property, and regulatory shocks limited the extent of reopening driving growth. Activity would be service-driven with no inflation spillovers globally.

Outcome: Growth has disappointed as households/ private sector remain highly cautious. Both CPI and PPI are in deflation, with no global demand or inflation spillovers.

2023: Small Banks Crisis.

We said: Small banks had lent more than large & outpaced them in reducing reserve assets at Fed. Marginal money-to-fund lending became expensive with real funds rate positive +heading higher. No 08 crisis but a pullback in lending as small bank capital adequacy ratios were low.

Outcome: Small bank problem blew up beginning March 9 when SVB announced a fund raise. Global banking problems ensued, took down Credit Suisse, and Fed/Treasury/FDIC announced emergency action on March 12.

2022: H1 Inflation anxiety. H2 disinflation

We said: July relaxation of Covid restrictions was interpreted as evidence that worst of Covid economic disruption was over, backed by June PMIs. Consumers key, and with no clear zero Covid exit path rebound in consumer stocks overdone. Went Long equity index vs short China CD sector.

Outcome: We closed the view for a 5% profit on 31 October.

Sell the China consumer recovery

We said: July relaxation of Covid restrictions was interpreted as evidence that worst of Covid economic disruption was over, backed by June PMIs. Consumers key, and with no clear zero Covid exit path rebound in consumer stocks overdone. Went Long equity index vs short China CD sector.

Outcome: We closed the view for a 5% profit on 31 October.

Commodities

We said: Expected highs set in March to hold for foreseeable future, with prices moving sideways as the tension between cooling macro tailwinds and tight supply fundamentals continued.

Outcome: Industrial metal prices corrected lower in June/July and have since traded in a range.

Bear market rally

We said: After bear call in Jan 2022 (Pincer for equity market) we warned of summer bear market rallies and told investors to fade them, the market would come later.

Outcome: S&P 500 was down 24% year to 30th of September, having experienced multiple bear market rallies throughout the summer.

Fed funds rate to 4%

We said: And then 4.5% rate too diluted. September 2022. Rate target to be greater than 4% by yearend in May then in September that markets believing Fed’s 4.5% solution gets inflation to 2% was wrong, instead Fed to push expectations to 5.5%.

Outcome: Market pricing for December Fed funds rose from 2.7% in May to 4.2% in September. Then Forward rate expectations over 5% toward the end of the year.

China Equities

We said: Bearish equities since 2021 due to weighting of tech stocks in the index, continued lockdowns and deteriorating US relations. Tactically long in May but returned to bearish since due to zero covid and Xi putting ideology ahead of the economy.

Outcome: MSCI China had a terrible 18 month declining 43%. We’ve recently gone tactically bullish on vaccination targets being set.

China growth

We said: Since Q4/21 we have forecast well below consensus China 2022 GDP growth. In March we raised the prospect of a Chinese growth recession this year, in July we turned even more bearish in contrast to upbeat sell side forecasts.

Outcome: China activity has surprised firmly to the downside. Consensus China growth forecasts have been slashed from 5.5% down to 3.3% with more downgrades likely.

RMB call

We said: We said it was a question of when not if the RMB would depreciate. We thought growth and rate differentials would drive USDCNY towards 7.2 by yearend. We also forecast RMB appreciation in H1/23 as we expected China to outperform the US.

Outcome: USDCNY touched 7.3 in November before the Fed and China pivots brought RMB appreciation a couple of months earlier than forecast.

Central Bank tightening

We said: This tightening cycle would be different, CBs would raise rates faster than previous cycles, unambiguously bad for financial markets as all good news on the economy was already priced in. Consensus at the time was CB tightening would be gradual and markets could shrug it off.

Outcome: Central Bank tightening dominated the narrative for financial markets in 2022

H1 inflation anxiety. H2 disinflation

We said: Hawkish Fed panic markets in H1 but inflation down in H2. Updated H2 view in July: a mirage of disinflation is set to emerge going into 2023.

Outcome: DM terminal rates continually priced higher as inflation anxiety increased; disinflation came through in late H2. Markets are underestimating Fed perseverance, but mirage began with October CPI print, causing widespread rally in markets.

Fed hike in March

We said: Called for 25bps hike on (8th December 2021), markets were 65/35 against a March hike at the time.

Outcome: Fed hiked 25bps on 26th March

China PBoC/fiscal call

We said: Called for easing (October 2021) as economy slowed and political calendar opened stimulus window.

Outcome: PBoC cut RRR by 50bps in December infrastructure and credit impulse bottomed out.

Brazil: A pragmatic Lula message

We said: On 8th February we went positive equities on the back of Lula's new political strategy.

Outcome: Brazil has been a big outperformer globally, in a difficult 2 months for equities.

Pincer for equity market

We said: Mid-January. Slow growth & tightening bias of central banks = negative for global equities.

Outcome: Equities have had a rocky time and the VIX spiked above 35 in March.

China slowdown to trigger policy put

We said: China slowdown would trigger policy put after the 6th Plenum. (October 2021), here (Oct 2021), here (Nov 2021), here (Nov 2021)

Outcome: China moved to broad easing following the 6th Plenum. Fiscal policy became more expensive via frontloaded government bond issuance. The PBoC cut RRR by 50 bps in December.

China equities to suffer

We said - March 2021: The underperformance of Chinese equities reflects multiple factors, including tightening regulation. Our judgement is that these developments will adversely influence Chinese equity performance in the near term. Accordingly, we cut our call on China equities to modest negative. July 2021: The new data security legislation makes it clear that control and storage of data are now a matter of sovereignty, presenting a risk to investors in MSCI China. Our bottom line is that more regulation is to come. We cut our call on China equities to strong negative.

Outcome: The regulatory tightening accelerated, raising concerns about the future profitability of many of China's most successful companies. MSCI China lost 9% between 22 March and 19 July, and a further 15% to the low point in August.

Chinese equities: A sapper's market

We said: China to promote Hong Kong as an offshore listing hub. VIE structure is acceptable in Hong Kong, VIE listing in the US is blocked.

Outcome: Didi forced to de-list from US exchanges and re-list in Hong Kong using a VIE structure.

MSCI China - Beware the "red cat" bounce

We said: MSCI China is cheap, but will struggle to break out of trading range due to regulatory and political risks.

Outcome: MSCI China has moved sideways, with breakout attempts repeatedly knocked back by new regulatory efforts. Following a late December sell off the index is down 9% from publication date.

China policy risk - fear and greed

We said: China small caps and policy favourites will outperform (June 2021) and here (July 2021) and lots more publications throughout the year.

Outcome: Our proxies for policy favourites (clean energy, and electric vehicle, battery and infrastructure EFTs) have risen by 27% and 30% respectively. MSCI China has fallen 30%.

Property investment slowdown

We said: Property investment will slump to a record low in H2/21 (October 2020) again here (March 2021) and here (June 2021).

Outcome: Tight liquidity and Evergrande default cause property FAI to drop sharply.

Commodity bull meets FOMO

We said: The metals-led commodity bull has legs, but the market shifts down a gear here.

Outcome: Copper and other key industrial metal prices had a sizeable downward correction in June.

ECB to focus on jobs now, but don’t hold your breath for ‘AIT’

We said: Despite growing internal divisions, we think the Governing Council will resist mounting pressures from "hawks" to scale back accommodation in June.

Outcome: The ECB left monetary policy unchanged, reiterating the pledge to buy assets at a "significantly" faster pace than in the first months of this year.

ECB's unclear reaction function

We said: We expected the ECB's unclear reaction function and a divided Governing Council to complicate the Bank's decision making process by increasing volatility and financing costs, by letting spreads widen.

Outcome: In spite of the central bank stepping up asset purchases from March, EA financing costs continued to edge higher and the yield curve steepened. This trend has paused for now, but it will resurface as the ECB reassesses its policy stance at the end of summer.

EA Growth Locked-Down Again

We said: We expect a double-dip recession in Q1 and real GDP to expand by 4% this year.

Outcome: Consensus expectations for Q1 output have been revised down from 0.6% q/q at the start of the year to -0.8% recently. Forecasts for the 2021 growth have been downgraded from 4.6% to 4.2%.

In 2021 monitor fiscal policy, jobs and savings

We said: Fiscal support will tighten next year, but “cliff edges” will be avoided. We expect authorities, even in the financially-constrained EA periphery, to stand ready to roll over furlough schemes, public guarantee schemes and loan moratoria until the pick-up in activity gathers pace in 2021H2.

Outcome: EA governments have continued to roll over all measures, explicitly acknowledging “cliff edge” risks in case of abrupt phase out of fiscal support.

Strong GDP rebound driven by robust fiscal spending

We said: While consumer spending could slow, the increased savings rate in Q3/20 should cushion a sharper drop in consumption in Q1/21.

Outcome: Household savings accumulated during H2/21 offset the effects of the end of the first round of "coronavoucher" payments during Q1/21.

The Fed shortened timeline

We said: From our perspective, the rebound looks rapid enough that by the time 2022 comes to an end, a 0.125% funds rate will be too low even for the FOMC.

Outcome: The market moved in this direction, so too with our expectation of “taper” by the end of 2021.

Vaccine rotation impact

We said: Add short USD/BRL. BRL is significantly overvalued, while inflation risks are rising and Banco Central is likely to take a more cautious stance. Despite fiscal uncertainty, our base case is that a crisis will be averted.

Outcome: Banco Central raised policy rates successively in order to rein in inflation expectations, while improving fundamentals further boosted the currency. Short USD/BRL position closed on 7 June 2021 for a total return P&L of 8.8%.

Growth-to-Value rotation (especially in small caps)

We said: Rising yields to spur Growth-Value rotation, again. As regards the Growth-to-Value rotation, the latest attempt was predicated on expectations of a "blue wave" in the US election, which failed to materialize. But a vaccine may succeed where hopes of a large fiscal stimulus did not, namely, by delivering a sustained and faster-than-previously-thought recovery in growth, employment and inflation. All this points to higher yields, which would be good for Financials - still the largest US sector by net income terms, if not market cap. And with consumer and business behaviour likely to normalize, all sectors that have been hit hard by the pandemic (hotels, restaurants, airlines, physical retail etc.) should also begin to recover.

Outcome: S&P 500 (large caps) Value +15%, Growth +6% ; Russell 2000 (small caps) Value + 39%, Growth +24%.

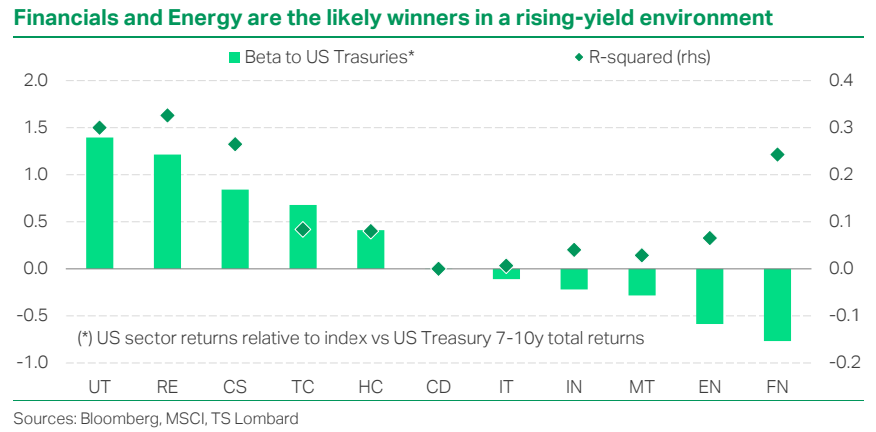

Energy, Financials to outperform; Utilities, Real Estate, Consumer Staples to underperform

We said: Utilities, Real Estate and Staples do well amid declining yields, while Financials (especially Banks) and Energy do better when yields are rising. This chart below shows which sectors are likely to benefit the most in an environment of rising yields. It shows the beta of sector returns relative to the index vs the total returns of US Treasuries. A positive beta means that a sector outperforms the index when UST returns are positive (yields fall); a negative beta means underperformance. Interestingly, yields have no significant bearing on Tech in our analysis.

Outcome: S&P 500 Energy +56%, Banks +36%; Utilities -8%, Staples – 1%, Real Estate +3%.

Industrial commodities to outperform gold

We said: If history is any guide, industrials are more likely to catch up with gold rather than the other way around. This would be consistent with a powerful turnaround in the global cycle, validating expectations for a steeper yield curve.

Outcome: Gold/CRB Industrials ratio down sharply, exceeding our expectations.

The K-shaped recovery in the euro area

We said: Euro area’s K-shaped recovery means German outperformance, struggling services but resilient manufacturing, and rising input costs but falling output prices.

Outcome: Germany continues to outperform the EA. Manufacturing is resilient while the services sector remains fragile. Margin pressure on producers has worsened over the last year and is the most intense since the EA debt crisis.

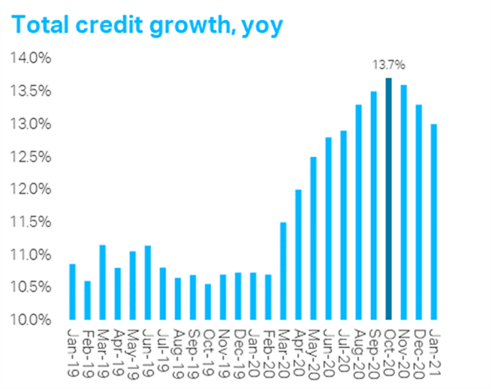

A hawkish PBOC

We said: While nominal total credit growth could still accelerate in Q3/20 owing to large-scale government bond issuance, it could start to peak out thereafter. Easier monetary policy is behind us and there is far less room for interest rate cuts. We now expect no change in MLF rates for the rest of 2020.

Outcome: Total credit growth peaked out in October at 13.7%. No rate cut after August in 2020.

RMB Bulls

We said: RMB bias to appreciate: China’s growth prospects remain on track, while the renminbi has held up well this year compared with most other currencies. At the same time, the PBoC has turned to more cautious easing, while the government uses fiscal policy to boost activity and fight deflation. Domestic fundamentals therefore remain supportive for the currency.

Outcome: See Chart - RMB Exchange Rates

Anticipating oil correction

We said: For the time being… we feel that a wait-and-see stance is warranted as the sustainability of the market’s advance is bound to come under more scrutiny.

Outcome: Prices rose another 6% in the following three weeks, then corrected lower by 18% over the next two months.

Fed Forecast

We Said: The inflation lessons of the expansion and demands to be responsive to minority employment mean the Fed’s new framework is employment first, and foremost. In the coming cycle, they will simply let employment run until inflation starts to rise. They give themselves the right to do this because the 2% ceiling is now a long-term average, and there have been many years with inflation under 2%. In the meantime, the essential promise of this policy is that the Fed is going to stay out of the way once the growth cycle takes hold.

Outcome: The above policy was officially announced by Powell at Jackson Hole a month later.

Buy China and EM on liquidity

We said: The positive impact of a weak dollar on EM currencies and assets is likely to moderate, but rising liquidity and easing of lockdown restrictions will nonetheless provide a boost for markets, even as lack of preparedness for a second wave remains a significant risk.

Outcome: Equity markets in China and EM ex-China continued to rally in June and July before starting to trade sideways in August.

Buy China, Korea and Taiwan

We said: China was first-in the Covid-19 crisis and would be first out. Korea and Taiwan also stood out for the management of the pandemic, their close linkages to China, and the weight of Tech in their stock market indices. In our AA model portfolio we’ve been o/w China Equities since March, and Korea and Taiwan since May.

Outcome: China equities are up 48% (in USD terms) since March; Korea and Taiwan by 34% and 31% since May, respectively – outperforming the MSCI-ex US, which rose 36% and 18% over these periods. (Performance as of 23-Oct-2020.)

Oil bottoming out

We said: Hard to see prices staying so low (and the contango so wide) for long, even as further downside volatility cannot be ruled out… By this time next year, do not be surprised if the market’s focus has shifted to upside oil price risks… the playbook might be different, but the cycle will still play out.

Outcome: Market turned around, prices now already back at January 2020 levels.

Overweight Korea Equities and FX

We said: In April, we forecasted the economic outperformance of Korea and Taiwan based on; covid containment, electronic component-heavy exports and proximity to China and its recovery. We doubled down on our projections for East Asian economic strength in July. Ahead of the US election, we added a further structural driver to Korean and Taiwanese growth – the tech war – which promises to boost demand for Asian high end electronic components.

Outcome: We went overweight Korean and Taiwanese equities in May 2020 and have been long the KRW in Macro Strategy since June. MSCI TW is the top performing index globally with MSCI KR just behind. As of 18/11/20 Our KRW trade is up 7.42%.

Deflation, not inflation the threat

We said: A large negative output gap, huge labour income losses, and a sharp rise in uncertainty and precautionary savings will keep inflationary pressures subdued in the euro area for longer. Surging money and credit growth – usually considered precursors to rapid economic growth – mask fragile underlying credit trends.

Outcome: Inflation has missed consensus forecasts since the pandemic. Inflation expectations for this year (according to a Bloomberg Survey) have been revised lower from 1% to 0.3%.

Oil price war: Saudi to blink first

We said: Saudi Arabia cannot afford it, and the collapsing demand environment is completely unfit for a volume vs price strategy. The war will be over by June – i.e. replaced by renewed supply-side restraint, supporting an oil price recovery.

Outcome: We were right, only too conservative on the timing: the Saudis folded five weeks later with the new OPEC+ agreement on 12 April slashing production by 25%.

Covid-19 to be demand shock, how policy should respond

We said: The Covid-19 pandemic will damage domestic demand, especially services. Countries in the EA periphery are the most exposed. Limiting the transmission of negative spill overs to firms’ cash flows and to employment is crucial to avoid more serious medium-term damage from contagion. Fiscal policy will need to be stepped up significantly. Don’t write off ECB easing: serious discussions about changing the ECB’s self-imposed limits on ECB QE should be on the cards by now.

Outcome: Domestic demand collapsed, led by services, especially in tourist-dependent EA periphery. EA consensus growth forecasts for this year were revised down from 1% to -8%. EA governments strengthened or introduced income/employment support programmes and provided liquidity to firms via guaranteed loans and equity injections causing national budget deficits to widen dramatically. Few days later, the ECB launched new liquidity measures including a €750bn asset purchase programme – the PEPP – to which the traditional asset purchase constraints did not apply.

Fed Cut Coming

We said: Called 75BP cut in funds rate.

Outcome: Fed cut rates 75BP the next Monday.

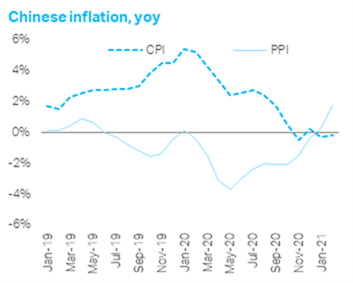

Disinflation convergence

We said: CPI and PPI will slowly converge to 0-1% in early 2021.

Outcome: Chinese PPI deflation rebounded from -2.1% in September 2020 to 0.3% in January. CPI declined from 1.7% in September 2020 to -0.3% in January.

Sell the China consumer recovery

We said: July relaxation of Covid restrictions was interpreted as evidence that worst of Covid economic disruption was over, backed by June PMIs. Consumers key, and with no clear zero Covid exit path rebound in consumer stocks overdone. Went Long equity index vs short China CD sector.

Outcome: We closed the view for a 5% profit on 31 October.

Commodities

We said: Expected highs set in March to hold for foreseeable future, with prices moving sideways as the tension between cooling macro tailwinds and tight supply fundamentals continued.

Outcome: Industrial metal prices corrected lower in June/July and have since traded in a range.

Bear market rally

We said: After bear call in Jan 2022 (Pincer for equity market) we warned of summer bear market rallies and told investors to fade them, the market would come later.

Outcome: S&P 500 was down 24% year to 30th of September, having experienced multiple bear market rallies throughout the summer.

Fed funds rate to 4%

We said: And then 4.5% rate too diluted. September 2022. Rate target to be greater than 4% by yearend in May then in September that markets believing Fed’s 4.5% solution gets inflation to 2% was wrong, instead Fed to push expectations to 5.5%.

Outcome: Market pricing for December Fed funds rose from 2.7% in May to 4.2% in September. Then Forward rate expectations over 5% toward the end of the year.

China Equities

We said: Bearish equities since 2021 due to weighting of tech stocks in the index, continued lockdowns and deteriorating US relations. Tactically long in May but returned to bearish since due to zero covid and Xi putting ideology ahead of the economy.

Outcome: MSCI China had a terrible 18 month declining 43%. We’ve recently gone tactically bullish on vaccination targets being set.

China growth

We said: Since Q4/21 we have forecast well below consensus China 2022 GDP growth. In March we raised the prospect of a Chinese growth recession this year, in July we turned even more bearish in contrast to upbeat sell side forecasts.

Outcome: China activity has surprised firmly to the downside. Consensus China growth forecasts have been slashed from 5.5% down to 3.3% with more downgrades likely.

RMB call

We said: We said it was a question of when not if the RMB would depreciate. We thought growth and rate differentials would drive USDCNY towards 7.2 by yearend. We also forecast RMB appreciation in H1/23 as we expected China to outperform the US.

Outcome: USDCNY touched 7.3 in November before the Fed and China pivots brought RMB appreciation a couple of months earlier than forecast.

Central Bank tightening

We said: This tightening cycle would be different, CBs would raise rates faster than previous cycles, unambiguously bad for financial markets as all good news on the economy was already priced in. Consensus at the time was CB tightening would be gradual and markets could shrug it off.

Outcome: Central Bank tightening dominated the narrative for financial markets in 2022

H1 inflation anxiety. H2 disinflation

We said: Hawkish Fed panic markets in H1 but inflation down in H2. Updated H2 view in July: a mirage of disinflation is set to emerge going into 2023.

Outcome: DM terminal rates continually priced higher as inflation anxiety increased; disinflation came through in late H2. Markets are underestimating Fed perseverance, but mirage began with October CPI print, causing widespread rally in markets.

Fed hike in March

We said: Called for 25bps hike on (8th December 2021), markets were 65/35 against a March hike at the time.

Outcome: Fed hiked 25bps on 26th March

China PBoC/fiscal call

We said: Called for easing (October 2021) as economy slowed and political calendar opened stimulus window.

Outcome: PBoC cut RRR by 50bps in December infrastructure and credit impulse bottomed out.

Brazil: A pragmatic Lula message

We said: On 8th February we went positive equities on the back of Lula's new political strategy.

Outcome: Brazil has been a big outperformer globally, in a difficult 2 months for equities.

Pincer for equity market

We said: Mid-January. Slow growth & tightening bias of central banks = negative for global equities.

Outcome: Equities have had a rocky time and the VIX spiked above 35 in March.

China slowdown to trigger policy put

We said: China slowdown would trigger policy put after the 6th Plenum. (October 2021), here (Oct 2021), here (Nov 2021), here (Nov 2021)

Outcome: China moved to broad easing following the 6th Plenum. Fiscal policy became more expensive via frontloaded government bond issuance. The PBoC cut RRR by 50 bps in December.

China equities to suffer

We said - March 2021: The underperformance of Chinese equities reflects multiple factors, including tightening regulation. Our judgement is that these developments will adversely influence Chinese equity performance in the near term. Accordingly, we cut our call on China equities to modest negative. July 2021: The new data security legislation makes it clear that control and storage of data are now a matter of sovereignty, presenting a risk to investors in MSCI China. Our bottom line is that more regulation is to come. We cut our call on China equities to strong negative.

Outcome: The regulatory tightening accelerated, raising concerns about the future profitability of many of China's most successful companies. MSCI China lost 9% between 22 March and 19 July, and a further 15% to the low point in August.

Chinese equities: A sapper's market

We said: China to promote Hong Kong as an offshore listing hub. VIE structure is acceptable in Hong Kong, VIE listing in the US is blocked.

Outcome: Didi forced to de-list from US exchanges and re-list in Hong Kong using a VIE structure.

MSCI China - Beware the "red cat" bounce

We said: MSCI China is cheap, but will struggle to break out of trading range due to regulatory and political risks.

Outcome: MSCI China has moved sideways, with breakout attempts repeatedly knocked back by new regulatory efforts. Following a late December sell off the index is down 9% from publication date.

China policy risk - fear and greed

We said: China small caps and policy favourites will outperform (June 2021) and here (July 2021) and lots more publications throughout the year.

Outcome: Our proxies for policy favourites (clean energy, and electric vehicle, battery and infrastructure EFTs) have risen by 27% and 30% respectively. MSCI China has fallen 30%.

Property investment slowdown

We said: Property investment will slump to a record low in H2/21 (October 2020) again here (March 2021) and here (June 2021).

Outcome: Tight liquidity and Evergrande default cause property FAI to drop sharply.

Commodity bull meets FOMO

We said: The metals-led commodity bull has legs, but the market shifts down a gear here.

Outcome: Copper and other key industrial metal prices had a sizeable downward correction in June.

ECB to focus on jobs now, but don’t hold your breath for ‘AIT’

We said: Despite growing internal divisions, we think the Governing Council will resist mounting pressures from "hawks" to scale back accommodation in June.

Outcome: The ECB left monetary policy unchanged, reiterating the pledge to buy assets at a "significantly" faster pace than in the first months of this year.

ECB's unclear reaction function

We said: We expected the ECB's unclear reaction function and a divided Governing Council to complicate the Bank's decision making process by increasing volatility and financing costs, by letting spreads widen.

Outcome: In spite of the central bank stepping up asset purchases from March, EA financing costs continued to edge higher and the yield curve steepened. This trend has paused for now, but it will resurface as the ECB reassesses its policy stance at the end of summer.

EA Growth Locked-Down Again

We said: We expect a double-dip recession in Q1 and real GDP to expand by 4% this year.

Outcome: Consensus expectations for Q1 output have been revised down from 0.6% q/q at the start of the year to -0.8% recently. Forecasts for the 2021 growth have been downgraded from 4.6% to 4.2%.

In 2021 monitor fiscal policy, jobs and savings

We said: Fiscal support will tighten next year, but “cliff edges” will be avoided. We expect authorities, even in the financially-constrained EA periphery, to stand ready to roll over furlough schemes, public guarantee schemes and loan moratoria until the pick-up in activity gathers pace in 2021H2.

Outcome: EA governments have continued to roll over all measures, explicitly acknowledging “cliff edge” risks in case of abrupt phase out of fiscal support.

Strong GDP rebound driven by robust fiscal spending

We said: While consumer spending could slow, the increased savings rate in Q3/20 should cushion a sharper drop in consumption in Q1/21.

Outcome: Household savings accumulated during H2/21 offset the effects of the end of the first round of "coronavoucher" payments during Q1/21.

The Fed shortened timeline

We said: From our perspective, the rebound looks rapid enough that by the time 2022 comes to an end, a 0.125% funds rate will be too low even for the FOMC.

Outcome: The market moved in this direction, so too with our expectation of “taper” by the end of 2021.

Vaccine rotation impact

We said: Add short USD/BRL. BRL is significantly overvalued, while inflation risks are rising and Banco Central is likely to take a more cautious stance. Despite fiscal uncertainty, our base case is that a crisis will be averted.

Outcome: Banco Central raised policy rates successively in order to rein in inflation expectations, while improving fundamentals further boosted the currency. Short USD/BRL position closed on 7 June 2021 for a total return P&L of 8.8%.

Growth-to-Value rotation (especially in small caps)

We said: Rising yields to spur Growth-Value rotation, again. As regards the Growth-to-Value rotation, the latest attempt was predicated on expectations of a "blue wave" in the US election, which failed to materialize. But a vaccine may succeed where hopes of a large fiscal stimulus did not, namely, by delivering a sustained and faster-than-previously-thought recovery in growth, employment and inflation. All this points to higher yields, which would be good for Financials - still the largest US sector by net income terms, if not market cap. And with consumer and business behaviour likely to normalize, all sectors that have been hit hard by the pandemic (hotels, restaurants, airlines, physical retail etc.) should also begin to recover.

Outcome: S&P 500 (large caps) Value +15%, Growth +6% ; Russell 2000 (small caps) Value + 39%, Growth +24%.

Energy, Financials to outperform; Utilities, Real Estate, Consumer Staples to underperform

We said: Utilities, Real Estate and Staples do well amid declining yields, while Financials (especially Banks) and Energy do better when yields are rising. This chart below shows which sectors are likely to benefit the most in an environment of rising yields. It shows the beta of sector returns relative to the index vs the total returns of US Treasuries. A positive beta means that a sector outperforms the index when UST returns are positive (yields fall); a negative beta means underperformance. Interestingly, yields have no significant bearing on Tech in our analysis.

Outcome: S&P 500 Energy +56%, Banks +36%; Utilities -8%, Staples – 1%, Real Estate +3%.

Industrial commodities to outperform gold

We said: If history is any guide, industrials are more likely to catch up with gold rather than the other way around. This would be consistent with a powerful turnaround in the global cycle, validating expectations for a steeper yield curve.

Outcome: Gold/CRB Industrials ratio down sharply, exceeding our expectations.

The K-shaped recovery in the euro area

We said: Euro area’s K-shaped recovery means German outperformance, struggling services but resilient manufacturing, and rising input costs but falling output prices.

Outcome: Germany continues to outperform the EA. Manufacturing is resilient while the services sector remains fragile. Margin pressure on producers has worsened over the last year and is the most intense since the EA debt crisis.

A hawkish PBOC

We said: While nominal total credit growth could still accelerate in Q3/20 owing to large-scale government bond issuance, it could start to peak out thereafter. Easier monetary policy is behind us and there is far less room for interest rate cuts. We now expect no change in MLF rates for the rest of 2020.

Outcome: Total credit growth peaked out in October at 13.7%. No rate cut after August in 2020.

RMB Bulls

We said: RMB bias to appreciate: China’s growth prospects remain on track, while the renminbi has held up well this year compared with most other currencies. At the same time, the PBoC has turned to more cautious easing, while the government uses fiscal policy to boost activity and fight deflation. Domestic fundamentals therefore remain supportive for the currency.

Outcome: See Chart - RMB Exchange Rates

Anticipating oil correction

We said: For the time being… we feel that a wait-and-see stance is warranted as the sustainability of the market’s advance is bound to come under more scrutiny.

Outcome: Prices rose another 6% in the following three weeks, then corrected lower by 18% over the next two months.

Fed Forecast

We Said: The inflation lessons of the expansion and demands to be responsive to minority employment mean the Fed’s new framework is employment first, and foremost. In the coming cycle, they will simply let employment run until inflation starts to rise. They give themselves the right to do this because the 2% ceiling is now a long-term average, and there have been many years with inflation under 2%. In the meantime, the essential promise of this policy is that the Fed is going to stay out of the way once the growth cycle takes hold.

Outcome: The above policy was officially announced by Powell at Jackson Hole a month later.

Buy China and EM on liquidity

We said: The positive impact of a weak dollar on EM currencies and assets is likely to moderate, but rising liquidity and easing of lockdown restrictions will nonetheless provide a boost for markets, even as lack of preparedness for a second wave remains a significant risk.

Outcome: Equity markets in China and EM ex-China continued to rally in June and July before starting to trade sideways in August.

Buy China, Korea and Taiwan

We said: China was first-in the Covid-19 crisis and would be first out. Korea and Taiwan also stood out for the management of the pandemic, their close linkages to China, and the weight of Tech in their stock market indices. In our AA model portfolio we’ve been o/w China Equities since March, and Korea and Taiwan since May.

Outcome: China equities are up 48% (in USD terms) since March; Korea and Taiwan by 34% and 31% since May, respectively – outperforming the MSCI-ex US, which rose 36% and 18% over these periods. (Performance as of 23-Oct-2020.)

Oil bottoming out

We said: Hard to see prices staying so low (and the contango so wide) for long, even as further downside volatility cannot be ruled out… By this time next year, do not be surprised if the market’s focus has shifted to upside oil price risks… the playbook might be different, but the cycle will still play out.

Outcome: Market turned around, prices now already back at January 2020 levels.

Overweight Korea Equities and FX

We said: In April, we forecasted the economic outperformance of Korea and Taiwan based on; covid containment, electronic component-heavy exports and proximity to China and its recovery. We doubled down on our projections for East Asian economic strength in July. Ahead of the US election, we added a further structural driver to Korean and Taiwanese growth – the tech war – which promises to boost demand for Asian high end electronic components.

Outcome: We went overweight Korean and Taiwanese equities in May 2020 and have been long the KRW in Macro Strategy since June. MSCI TW is the top performing index globally with MSCI KR just behind. As of 18/11/20 Our KRW trade is up 7.42%.

Deflation, not inflation the threat

We said: A large negative output gap, huge labour income losses, and a sharp rise in uncertainty and precautionary savings will keep inflationary pressures subdued in the euro area for longer. Surging money and credit growth – usually considered precursors to rapid economic growth – mask fragile underlying credit trends.

Outcome: Inflation has missed consensus forecasts since the pandemic. Inflation expectations for this year (according to a Bloomberg Survey) have been revised lower from 1% to 0.3%.

Oil price war: Saudi to blink first

We said: Saudi Arabia cannot afford it, and the collapsing demand environment is completely unfit for a volume vs price strategy. The war will be over by June – i.e. replaced by renewed supply-side restraint, supporting an oil price recovery.

Outcome: We were right, only too conservative on the timing: the Saudis folded five weeks later with the new OPEC+ agreement on 12 April slashing production by 25%.

Covid-19 to be demand shock, how policy should respond

We said: The Covid-19 pandemic will damage domestic demand, especially services. Countries in the EA periphery are the most exposed. Limiting the transmission of negative spill overs to firms’ cash flows and to employment is crucial to avoid more serious medium-term damage from contagion. Fiscal policy will need to be stepped up significantly. Don’t write off ECB easing: serious discussions about changing the ECB’s self-imposed limits on ECB QE should be on the cards by now.

Outcome: Domestic demand collapsed, led by services, especially in tourist-dependent EA periphery. EA consensus growth forecasts for this year were revised down from 1% to -8%. EA governments strengthened or introduced income/employment support programmes and provided liquidity to firms via guaranteed loans and equity injections causing national budget deficits to widen dramatically. Few days later, the ECB launched new liquidity measures including a €750bn asset purchase programme – the PEPP – to which the traditional asset purchase constraints did not apply.

Fed Cut Coming

We said: Called 75BP cut in funds rate.

Outcome: Fed cut rates 75BP the next Monday.

Disinflation convergence

We said: CPI and PPI will slowly converge to 0-1% in early 2021.

Outcome: Chinese PPI deflation rebounded from -2.1% in September 2020 to 0.3% in January. CPI declined from 1.7% in September 2020 to -0.3% in January.

Sell the China consumer recovery

We said: July relaxation of Covid restrictions was interpreted as evidence that worst of Covid economic disruption was over, backed by June PMIs. Consumers key, and with no clear zero Covid exit path rebound in consumer stocks overdone. Went Long equity index vs short China CD sector.

Outcome: We closed the view for a 5% profit on 31 October.

Commodities

We said: Expected highs set in March to hold for foreseeable future, with prices moving sideways as the tension between cooling macro tailwinds and tight supply fundamentals continued.

Outcome: Industrial metal prices corrected lower in June/July and have since traded in a range.

Bear market rally

We said: After bear call in Jan 2022 (Pincer for equity market) we warned of summer bear market rallies and told investors to fade them, the market would come later.

Outcome: S&P 500 was down 24% year to 30th of September, having experienced multiple bear market rallies throughout the summer.

Fed funds rate to 4%

We said: And then 4.5% rate too diluted. September 2022. Rate target to be greater than 4% by yearend in May then in September that markets believing Fed’s 4.5% solution gets inflation to 2% was wrong, instead Fed to push expectations to 5.5%.

Outcome: Market pricing for December Fed funds rose from 2.7% in May to 4.2% in September. Then Forward rate expectations over 5% toward the end of the year.

China Equities

We said: Bearish equities since 2021 due to weighting of tech stocks in the index, continued lockdowns and deteriorating US relations. Tactically long in May but returned to bearish since due to zero covid and Xi putting ideology ahead of the economy.

Outcome: MSCI China had a terrible 18 month declining 43%. We’ve recently gone tactically bullish on vaccination targets being set.

China growth

We said: Since Q4/21 we have forecast well below consensus China 2022 GDP growth. In March we raised the prospect of a Chinese growth recession this year, in July we turned even more bearish in contrast to upbeat sell side forecasts.

Outcome: China activity has surprised firmly to the downside. Consensus China growth forecasts have been slashed from 5.5% down to 3.3% with more downgrades likely.

RMB call

We said: We said it was a question of when not if the RMB would depreciate. We thought growth and rate differentials would drive USDCNY towards 7.2 by yearend. We also forecast RMB appreciation in H1/23 as we expected China to outperform the US.

Outcome: USDCNY touched 7.3 in November before the Fed and China pivots brought RMB appreciation a couple of months earlier than forecast.

Central Bank tightening

We said: This tightening cycle would be different, CBs would raise rates faster than previous cycles, unambiguously bad for financial markets as all good news on the economy was already priced in. Consensus at the time was CB tightening would be gradual and markets could shrug it off.

Outcome: Central Bank tightening dominated the narrative for financial markets in 2022

H1 inflation anxiety. H2 disinflation

We said: Hawkish Fed panic markets in H1 but inflation down in H2. Updated H2 view in July: a mirage of disinflation is set to emerge going into 2023.

Outcome: DM terminal rates continually priced higher as inflation anxiety increased; disinflation came through in late H2. Markets are underestimating Fed perseverance, but mirage began with October CPI print, causing widespread rally in markets.

Fed hike in March

We said: Called for 25bps hike on (8th December 2021), markets were 65/35 against a March hike at the time.

Outcome: Fed hiked 25bps on 26th March

China PBoC/fiscal call

We said: Called for easing (October 2021) as economy slowed and political calendar opened stimulus window.

Outcome: PBoC cut RRR by 50bps in December infrastructure and credit impulse bottomed out.

Brazil: A pragmatic Lula message

We said: On 8th February we went positive equities on the back of Lula's new political strategy.

Outcome: Brazil has been a big outperformer globally, in a difficult 2 months for equities.

Pincer for equity market

We said: Mid-January. Slow growth & tightening bias of central banks = negative for global equities.

Outcome: Equities have had a rocky time and the VIX spiked above 35 in March.

China slowdown to trigger policy put

We said: China slowdown would trigger policy put after the 6th Plenum. (October 2021), here (Oct 2021), here (Nov 2021), here (Nov 2021)

Outcome: China moved to broad easing following the 6th Plenum. Fiscal policy became more expensive via frontloaded government bond issuance. The PBoC cut RRR by 50 bps in December.

China equities to suffer

We said - March 2021: The underperformance of Chinese equities reflects multiple factors, including tightening regulation. Our judgement is that these developments will adversely influence Chinese equity performance in the near term. Accordingly, we cut our call on China equities to modest negative. July 2021: The new data security legislation makes it clear that control and storage of data are now a matter of sovereignty, presenting a risk to investors in MSCI China. Our bottom line is that more regulation is to come. We cut our call on China equities to strong negative.

Outcome: The regulatory tightening accelerated, raising concerns about the future profitability of many of China's most successful companies. MSCI China lost 9% between 22 March and 19 July, and a further 15% to the low point in August.

Chinese equities: A sapper's market

We said: China to promote Hong Kong as an offshore listing hub. VIE structure is acceptable in Hong Kong, VIE listing in the US is blocked.

Outcome: Didi forced to de-list from US exchanges and re-list in Hong Kong using a VIE structure.

MSCI China - Beware the "red cat" bounce

We said: MSCI China is cheap, but will struggle to break out of trading range due to regulatory and political risks.

Outcome: MSCI China has moved sideways, with breakout attempts repeatedly knocked back by new regulatory efforts. Following a late December sell off the index is down 9% from publication date.

China policy risk - fear and greed

We said: China small caps and policy favourites will outperform (June 2021) and here (July 2021) and lots more publications throughout the year.

Outcome: Our proxies for policy favourites (clean energy, and electric vehicle, battery and infrastructure EFTs) have risen by 27% and 30% respectively. MSCI China has fallen 30%.

Property investment slowdown

We said: Property investment will slump to a record low in H2/21 (October 2020) again here (March 2021) and here (June 2021).

Outcome: Tight liquidity and Evergrande default cause property FAI to drop sharply.

Commodity bull meets FOMO

We said: The metals-led commodity bull has legs, but the market shifts down a gear here.

Outcome: Copper and other key industrial metal prices had a sizeable downward correction in June.

ECB to focus on jobs now, but don’t hold your breath for ‘AIT’

We said: Despite growing internal divisions, we think the Governing Council will resist mounting pressures from "hawks" to scale back accommodation in June.

Outcome: The ECB left monetary policy unchanged, reiterating the pledge to buy assets at a "significantly" faster pace than in the first months of this year.

ECB's unclear reaction function

We said: We expected the ECB's unclear reaction function and a divided Governing Council to complicate the Bank's decision making process by increasing volatility and financing costs, by letting spreads widen.

Outcome: In spite of the central bank stepping up asset purchases from March, EA financing costs continued to edge higher and the yield curve steepened. This trend has paused for now, but it will resurface as the ECB reassesses its policy stance at the end of summer.

EA Growth Locked-Down Again

We said: We expect a double-dip recession in Q1 and real GDP to expand by 4% this year.

Outcome: Consensus expectations for Q1 output have been revised down from 0.6% q/q at the start of the year to -0.8% recently. Forecasts for the 2021 growth have been downgraded from 4.6% to 4.2%.

In 2021 monitor fiscal policy, jobs and savings

We said: Fiscal support will tighten next year, but “cliff edges” will be avoided. We expect authorities, even in the financially-constrained EA periphery, to stand ready to roll over furlough schemes, public guarantee schemes and loan moratoria until the pick-up in activity gathers pace in 2021H2.

Outcome: EA governments have continued to roll over all measures, explicitly acknowledging “cliff edge” risks in case of abrupt phase out of fiscal support.

Strong GDP rebound driven by robust fiscal spending

We said: While consumer spending could slow, the increased savings rate in Q3/20 should cushion a sharper drop in consumption in Q1/21.

Outcome: Household savings accumulated during H2/21 offset the effects of the end of the first round of "coronavoucher" payments during Q1/21.

The Fed shortened timeline

We said: From our perspective, the rebound looks rapid enough that by the time 2022 comes to an end, a 0.125% funds rate will be too low even for the FOMC.

Outcome: The market moved in this direction, so too with our expectation of “taper” by the end of 2021.

Vaccine rotation impact

We said: Add short USD/BRL. BRL is significantly overvalued, while inflation risks are rising and Banco Central is likely to take a more cautious stance. Despite fiscal uncertainty, our base case is that a crisis will be averted.

Outcome: Banco Central raised policy rates successively in order to rein in inflation expectations, while improving fundamentals further boosted the currency. Short USD/BRL position closed on 7 June 2021 for a total return P&L of 8.8%.

Growth-to-Value rotation (especially in small caps)

We said: Rising yields to spur Growth-Value rotation, again. As regards the Growth-to-Value rotation, the latest attempt was predicated on expectations of a "blue wave" in the US election, which failed to materialize. But a vaccine may succeed where hopes of a large fiscal stimulus did not, namely, by delivering a sustained and faster-than-previously-thought recovery in growth, employment and inflation. All this points to higher yields, which would be good for Financials - still the largest US sector by net income terms, if not market cap. And with consumer and business behaviour likely to normalize, all sectors that have been hit hard by the pandemic (hotels, restaurants, airlines, physical retail etc.) should also begin to recover.

Outcome: S&P 500 (large caps) Value +15%, Growth +6% ; Russell 2000 (small caps) Value + 39%, Growth +24%.

Energy, Financials to outperform; Utilities, Real Estate, Consumer Staples to underperform

We said: Utilities, Real Estate and Staples do well amid declining yields, while Financials (especially Banks) and Energy do better when yields are rising. This chart below shows which sectors are likely to benefit the most in an environment of rising yields. It shows the beta of sector returns relative to the index vs the total returns of US Treasuries. A positive beta means that a sector outperforms the index when UST returns are positive (yields fall); a negative beta means underperformance. Interestingly, yields have no significant bearing on Tech in our analysis.

Outcome: S&P 500 Energy +56%, Banks +36%; Utilities -8%, Staples – 1%, Real Estate +3%.

Industrial commodities to outperform gold

We said: If history is any guide, industrials are more likely to catch up with gold rather than the other way around. This would be consistent with a powerful turnaround in the global cycle, validating expectations for a steeper yield curve.

Outcome: Gold/CRB Industrials ratio down sharply, exceeding our expectations.

The K-shaped recovery in the euro area

We said: Euro area’s K-shaped recovery means German outperformance, struggling services but resilient manufacturing, and rising input costs but falling output prices.

Outcome: Germany continues to outperform the EA. Manufacturing is resilient while the services sector remains fragile. Margin pressure on producers has worsened over the last year and is the most intense since the EA debt crisis.

A hawkish PBOC

We said: While nominal total credit growth could still accelerate in Q3/20 owing to large-scale government bond issuance, it could start to peak out thereafter. Easier monetary policy is behind us and there is far less room for interest rate cuts. We now expect no change in MLF rates for the rest of 2020.

Outcome: Total credit growth peaked out in October at 13.7%. No rate cut after August in 2020.

RMB Bulls

We said: RMB bias to appreciate: China’s growth prospects remain on track, while the renminbi has held up well this year compared with most other currencies. At the same time, the PBoC has turned to more cautious easing, while the government uses fiscal policy to boost activity and fight deflation. Domestic fundamentals therefore remain supportive for the currency.

Outcome: See Chart - RMB Exchange Rates

Anticipating oil correction

We said: For the time being… we feel that a wait-and-see stance is warranted as the sustainability of the market’s advance is bound to come under more scrutiny.

Outcome: Prices rose another 6% in the following three weeks, then corrected lower by 18% over the next two months.

Fed Forecast

We Said: The inflation lessons of the expansion and demands to be responsive to minority employment mean the Fed’s new framework is employment first, and foremost. In the coming cycle, they will simply let employment run until inflation starts to rise. They give themselves the right to do this because the 2% ceiling is now a long-term average, and there have been many years with inflation under 2%. In the meantime, the essential promise of this policy is that the Fed is going to stay out of the way once the growth cycle takes hold.

Outcome: The above policy was officially announced by Powell at Jackson Hole a month later.

Buy China and EM on liquidity

We said: The positive impact of a weak dollar on EM currencies and assets is likely to moderate, but rising liquidity and easing of lockdown restrictions will nonetheless provide a boost for markets, even as lack of preparedness for a second wave remains a significant risk.

Outcome: Equity markets in China and EM ex-China continued to rally in June and July before starting to trade sideways in August.

Buy China, Korea and Taiwan

We said: China was first-in the Covid-19 crisis and would be first out. Korea and Taiwan also stood out for the management of the pandemic, their close linkages to China, and the weight of Tech in their stock market indices. In our AA model portfolio we’ve been o/w China Equities since March, and Korea and Taiwan since May.

Outcome: China equities are up 48% (in USD terms) since March; Korea and Taiwan by 34% and 31% since May, respectively – outperforming the MSCI-ex US, which rose 36% and 18% over these periods. (Performance as of 23-Oct-2020.)

Oil bottoming out

We said: Hard to see prices staying so low (and the contango so wide) for long, even as further downside volatility cannot be ruled out… By this time next year, do not be surprised if the market’s focus has shifted to upside oil price risks… the playbook might be different, but the cycle will still play out.

Outcome: Market turned around, prices now already back at January 2020 levels.

Overweight Korea Equities and FX

We said: In April, we forecasted the economic outperformance of Korea and Taiwan based on; covid containment, electronic component-heavy exports and proximity to China and its recovery. We doubled down on our projections for East Asian economic strength in July. Ahead of the US election, we added a further structural driver to Korean and Taiwanese growth – the tech war – which promises to boost demand for Asian high end electronic components.

Outcome: We went overweight Korean and Taiwanese equities in May 2020 and have been long the KRW in Macro Strategy since June. MSCI TW is the top performing index globally with MSCI KR just behind. As of 18/11/20 Our KRW trade is up 7.42%.

Deflation, not inflation the threat

We said: A large negative output gap, huge labour income losses, and a sharp rise in uncertainty and precautionary savings will keep inflationary pressures subdued in the euro area for longer. Surging money and credit growth – usually considered precursors to rapid economic growth – mask fragile underlying credit trends.

Outcome: Inflation has missed consensus forecasts since the pandemic. Inflation expectations for this year (according to a Bloomberg Survey) have been revised lower from 1% to 0.3%.

Oil price war: Saudi to blink first

We said: Saudi Arabia cannot afford it, and the collapsing demand environment is completely unfit for a volume vs price strategy. The war will be over by June – i.e. replaced by renewed supply-side restraint, supporting an oil price recovery.

Outcome: We were right, only too conservative on the timing: the Saudis folded five weeks later with the new OPEC+ agreement on 12 April slashing production by 25%.

Covid-19 to be demand shock, how policy should respond

We said: The Covid-19 pandemic will damage domestic demand, especially services. Countries in the EA periphery are the most exposed. Limiting the transmission of negative spill overs to firms’ cash flows and to employment is crucial to avoid more serious medium-term damage from contagion. Fiscal policy will need to be stepped up significantly. Don’t write off ECB easing: serious discussions about changing the ECB’s self-imposed limits on ECB QE should be on the cards by now.

Outcome: Domestic demand collapsed, led by services, especially in tourist-dependent EA periphery. EA consensus growth forecasts for this year were revised down from 1% to -8%. EA governments strengthened or introduced income/employment support programmes and provided liquidity to firms via guaranteed loans and equity injections causing national budget deficits to widen dramatically. Few days later, the ECB launched new liquidity measures including a €750bn asset purchase programme – the PEPP – to which the traditional asset purchase constraints did not apply.

Fed Cut Coming

We said: Called 75BP cut in funds rate.

Outcome: Fed cut rates 75BP the next Monday.

Disinflation convergence

We said: CPI and PPI will slowly converge to 0-1% in early 2021.

Outcome: Chinese PPI deflation rebounded from -2.1% in September 2020 to 0.3% in January. CPI declined from 1.7% in September 2020 to -0.3% in January.

Client Login

Client Login Contact

Contact